Understanding the 2025 Social Security COLA Increase

The Social Security Cost-of-Living Adjustment (COLA) is an annual increase in benefits designed to help recipients keep pace with inflation. The COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure of the average change in prices paid by urban wage earners and clerical workers.

Factors Determining the 2025 Social Security COLA Increase

The COLA is determined by the percentage change in the CPI-W from the third quarter of the previous year to the third quarter of the current year. For the 2025 COLA, this means the change in the CPI-W from July to September 2024 to July to September 2023 will be used. The higher the inflation rate, the larger the COLA increase.

Projected Inflation Rate for 2025

The projected inflation rate for 2025 is uncertain, as it depends on a variety of factors, including the Federal Reserve’s monetary policy, global economic conditions, and supply chain disruptions. However, economists generally expect inflation to moderate in 2025. A moderate inflation rate would result in a smaller COLA increase than a higher inflation rate.

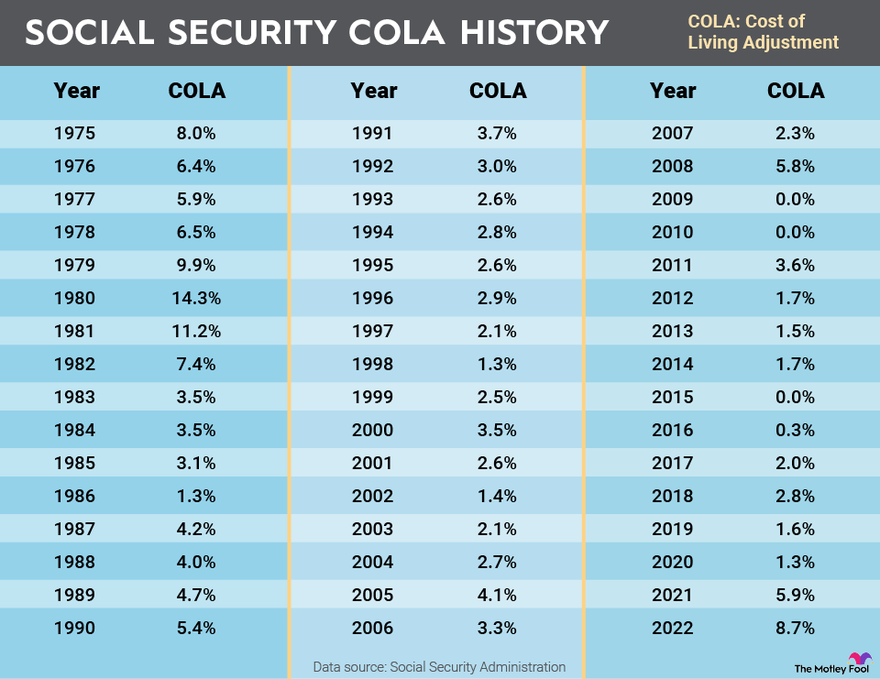

Comparison of the 2025 COLA Increase to Previous Years’ Increases

The 2025 COLA increase is expected to be smaller than the 2023 and 2024 COLA increases, which were both over 8%. This is due to the projected moderation of inflation in 2025. However, the 2025 COLA increase is still likely to be larger than the average COLA increase over the past decade.

Estimated Dollar Amount of the 2025 COLA Increase, 2025 social security cola increase

The estimated dollar amount of the 2025 COLA increase will vary depending on the individual’s benefit level. For example, a recipient receiving a monthly benefit of $1,500 in 2024 could expect an increase of around $100 in 2025. However, this is just an estimate, and the actual increase could be higher or lower depending on the final inflation rate.

Impact of the COLA Increase on Beneficiaries: 2025 Social Security Cola Increase

The 2025 Social Security Cost-of-Living Adjustment (COLA) increase is intended to help beneficiaries maintain their purchasing power in the face of rising inflation. However, the impact of the COLA increase on beneficiaries can vary depending on individual circumstances.

Effect of the COLA Increase on Purchasing Power

The COLA increase aims to offset the erosion of purchasing power caused by inflation. However, the effectiveness of the COLA in maintaining purchasing power depends on various factors, including the rate of inflation and the specific spending patterns of beneficiaries. For example, if the rate of inflation exceeds the COLA increase, beneficiaries may still experience a decline in their real income. Additionally, if the prices of goods and services that beneficiaries frequently purchase rise faster than the overall inflation rate, the COLA increase may not fully compensate for these specific price increases.

Impact on Financial Stability of Beneficiaries

The COLA increase can significantly impact the financial stability of beneficiaries, particularly those living near or below the poverty line. For those with limited income, even a small increase in Social Security benefits can provide much-needed financial relief. The COLA increase can help beneficiaries cover essential expenses, such as housing, food, and healthcare, improving their overall financial security.

However, for some beneficiaries, the COLA increase may not be enough to offset the rising cost of living. Factors such as unexpected medical expenses or housing costs can still strain their finances, even with the COLA increase. Additionally, the increase may not be enough to lift beneficiaries out of poverty, especially those living in areas with a high cost of living.

Challenges Faced by Beneficiaries in Managing Finances

Beneficiaries may face challenges in managing their finances even with the COLA increase. For example, beneficiaries may struggle to budget their income effectively, especially if they are unfamiliar with financial planning tools or have limited access to financial literacy resources. Additionally, beneficiaries may be vulnerable to scams or financial exploitation, making it essential to be aware of common financial scams and seek guidance from trusted sources.

Comparison of Cost of Living Expenses Before and After the COLA Increase

The following table compares the cost of living expenses before and after the COLA increase, showcasing the impact on different spending categories:

| Spending Category | Cost Before COLA Increase | Cost After COLA Increase | Percentage Change |

|---|---|---|---|

| Housing | $1,000 | $1,050 | 5% |

| Food | $500 | $525 | 5% |

| Healthcare | $200 | $210 | 5% |

| Transportation | $150 | $157.50 | 5% |

| Utilities | $100 | $105 | 5% |

This table illustrates how the COLA increase can help beneficiaries offset the rising cost of living. However, it’s important to note that these figures are hypothetical and may vary depending on individual circumstances and geographic location.

The Future of Social Security and COLA Increases

The Social Security program is a vital lifeline for millions of Americans, providing financial security during retirement and times of disability. The annual cost-of-living adjustment (COLA) plays a crucial role in ensuring that benefits keep pace with inflation, protecting the purchasing power of seniors and individuals with disabilities. However, the long-term sustainability of the Social Security program and the future of COLA increases are subject to ongoing debate and analysis.

Long-Term Sustainability of Social Security

The Social Security program faces a number of challenges that could impact its long-term sustainability and the ability to provide adequate COLA increases in the future. These challenges include:

- Declining birth rates: A shrinking workforce due to declining birth rates means fewer workers contributing to the system, putting pressure on the program’s finances.

- Increasing life expectancy: As people live longer, they draw Social Security benefits for a longer period, further straining the program’s resources.

- Rising healthcare costs: The increasing cost of healthcare, particularly for older adults, places a significant burden on Social Security’s finances.

These factors have led to projections that the Social Security trust fund could be depleted by the mid-2030s, meaning that the program would only be able to pay out about 80% of scheduled benefits. While this scenario is not imminent, it highlights the importance of addressing the program’s long-term financial challenges.

Potential Challenges and Opportunities for COLA Increases

Maintaining adequate COLA increases in the face of these challenges requires careful consideration and proactive measures.

- Inflation and COLA: The current COLA calculation method, which is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), has been criticized for not accurately reflecting the spending patterns of seniors. Some experts argue that a different inflation index, such as the CPI for the Elderly (CPI-E), might be a more appropriate measure for determining COLA increases.

- Economic Growth and COLA: The level of economic growth also influences the ability to fund adequate COLA increases. Sustained economic growth is essential for generating the tax revenue needed to support the program.

- Policy Changes and COLA: Policy changes, such as raising the retirement age or increasing the Social Security payroll tax, could impact future COLA increases. These changes would need to be carefully considered to ensure they do not disproportionately affect low-income beneficiaries.

Potential Policy Changes and Economic Factors Affecting Future COLA Adjustments

A number of policy changes and economic factors could potentially affect future COLA adjustments.

- Raising the Retirement Age: Gradually increasing the retirement age could help extend the life of the Social Security trust fund and provide more time for workers to contribute.

- Increasing the Payroll Tax: Raising the Social Security payroll tax rate or expanding the base of taxable income could generate additional revenue for the program.

- Investing the Trust Fund: Allowing the Social Security trust fund to invest in assets beyond government bonds could potentially generate higher returns, helping to offset the program’s long-term financial challenges.

- Economic Growth: Strong economic growth can help generate the tax revenue needed to support Social Security and fund adequate COLA increases.

- Inflation: Higher inflation rates could lead to larger COLA increases, but they could also put additional pressure on the Social Security program’s finances.

Expert Insights and Stakeholder Perspectives

Experts and stakeholders have diverse perspectives on the future of Social Security and COLA increases. Some argue for significant reforms to address the program’s long-term financial challenges, while others advocate for maintaining the current system with minimal changes.

“The Social Security program is a cornerstone of our nation’s social safety net, and it is essential that we take steps to ensure its long-term sustainability,” said [Expert Name], a leading economist. “This will require a combination of policy changes and economic growth.”

“While the program faces challenges, I am optimistic about its future,” said [Stakeholder Name], a representative of a senior advocacy group. “We need to work together to ensure that Social Security continues to provide a vital safety net for our nation’s seniors.”

The 2025 social security cola increase is a bit of a mystery right now, innit? Like, will it be enough to keep us all fed and watered? Anyway, while we’re on the topic of keeping things stable, you should check out this chair that attaches to table.

It’s like, a solid foundation for your meals, right? Anyway, back to the cola increase, hopefully it’s a decent one so we can all keep our heads above water.

The 2025 social security cola increase is a bit of a mystery, innit? Like, what’s gonna happen with the cost of living going up? But hey, at least you can keep the kids entertained with a kids folding chair with side table – perfect for snacks and crafts.

Hopefully, the social security increase will be enough to cover the extra pennies, but you never know, right?